Gifting An Ira - Web learn three ways to gift your retirement savings to your loved ones without paying taxes: Web it is possible to gift you ira to an individual or a charity. When gifting to an individual, he or she must not be a disqualified person and understand the cancellation of indebtedness rules. Then make sure you gift less than the annual exclusion amount (for 2022, it’s $16,000). First, you’ll need to be over age 59 ½ and taking qualified distributions. Web because the 2023 maximum annual ira contribution limit is $6,500 or $7,500 if you are least age 50, one can gift up to $17,000 to multiple family members to help fund an ira. But if your gift of money from an ira surpasses a. Web it can be given to a family member, donated to a charity, or used to purchase other assets. The donor should gift the funds directly to the family member or friend and then that individual can make the ira contribution into the ira from the funds gifted. Web smart gifting using retirement assets before you think about donating to charity, consider the source.

Charitable Gifts from your IRA Total Wealth Planning

Web a married couple could therefore give $36,000 to each of their children and grandchildren and anyone. Web smart gifting using retirement assets before you think about donating to charity, consider the source. First, you’ll need to be over age 59 ½ and taking qualified distributions. When gifting to an individual, he or she must not be a disqualified person.

What Is An IRA And How Does It Work? (2024)

Web it is possible to gift you ira to an individual or a charity. Web it can be given to a family member, donated to a charity, or used to purchase other assets. Web learn three ways to gift your retirement savings to your loved ones without paying taxes: First, you’ll need to be over age 59 ½ and taking.

What is an IRA? Practical Credit

Web because the 2023 maximum annual ira contribution limit is $6,500 or $7,500 if you are least age 50, one can gift up to $17,000 to multiple family members to help fund an ira. Web learn three ways to gift your retirement savings to your loved ones without paying taxes: But if your gift of money from an ira surpasses.

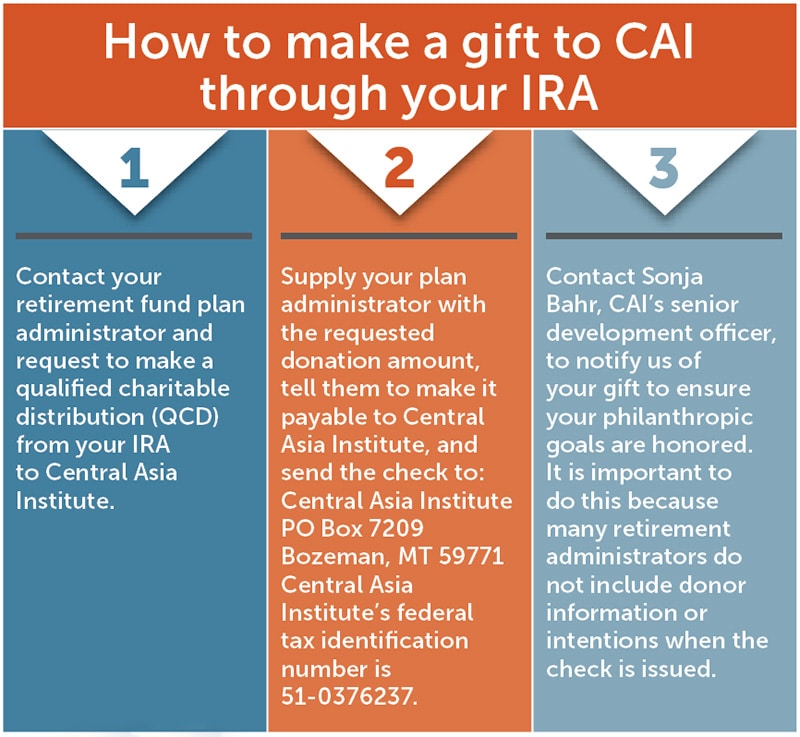

Giving to CAI through your IRA is as easy as 123 Central Asia Institute

First, you’ll need to be over age 59 ½ and taking qualified distributions. Web learn three ways to gift your retirement savings to your loved ones without paying taxes: But if your gift of money from an ira surpasses a. The donor should gift the funds directly to the family member or friend and then that individual can make the.

Can you gift an IRA? YouTube

Web it is possible to gift you ira to an individual or a charity. Web learn three ways to gift your retirement savings to your loved ones without paying taxes: Web because the 2023 maximum annual ira contribution limit is $6,500 or $7,500 if you are least age 50, one can gift up to $17,000 to multiple family members to.

Giving Through An IRA Children’s Medical Center Foundation

Web you can gift money from an ira without paying taxes, as long as you meet a few requirements. Web smart gifting using retirement assets before you think about donating to charity, consider the source. First, you’ll need to be over age 59 ½ and taking qualified distributions. Web it is possible to gift you ira to an individual or.

Gifting Your IRA to Your Favorite Charity Morrison Law Group, PLC

The donor should gift the funds directly to the family member or friend and then that individual can make the ira contribution into the ira from the funds gifted. Web you can gift money from an ira without paying taxes, as long as you meet a few requirements. Web a married couple could therefore give $36,000 to each of their.

Naming a Trust as Beneficiary of an IRA Barr & Young Attorneys

Web a married couple could therefore give $36,000 to each of their children and grandchildren and anyone. First, you’ll need to be over age 59 ½ and taking qualified distributions. Web you can gift money from an ira without paying taxes, as long as you meet a few requirements. But if your gift of money from an ira surpasses a..

Give From Your IRA the University of Pittsburgh

Web it is possible to gift you ira to an individual or a charity. Web smart gifting using retirement assets before you think about donating to charity, consider the source. Web learn three ways to gift your retirement savings to your loved ones without paying taxes: Web because the 2023 maximum annual ira contribution limit is $6,500 or $7,500 if.

See the Impact of Your Generosity Today Using Your IRA

First, you’ll need to be over age 59 ½ and taking qualified distributions. Web it is possible to gift you ira to an individual or a charity. When gifting to an individual, he or she must not be a disqualified person and understand the cancellation of indebtedness rules. Web learn three ways to gift your retirement savings to your loved.

First, you’ll need to be over age 59 ½ and taking qualified distributions. But if your gift of money from an ira surpasses a. Web it is possible to gift you ira to an individual or a charity. Then make sure you gift less than the annual exclusion amount (for 2022, it’s $16,000). Web smart gifting using retirement assets before you think about donating to charity, consider the source. Web because the 2023 maximum annual ira contribution limit is $6,500 or $7,500 if you are least age 50, one can gift up to $17,000 to multiple family members to help fund an ira. When gifting to an individual, he or she must not be a disqualified person and understand the cancellation of indebtedness rules. Web a married couple could therefore give $36,000 to each of their children and grandchildren and anyone. Web learn three ways to gift your retirement savings to your loved ones without paying taxes: Web you can gift money from an ira without paying taxes, as long as you meet a few requirements. Web it can be given to a family member, donated to a charity, or used to purchase other assets. The donor should gift the funds directly to the family member or friend and then that individual can make the ira contribution into the ira from the funds gifted.

Web Because The 2023 Maximum Annual Ira Contribution Limit Is $6,500 Or $7,500 If You Are Least Age 50, One Can Gift Up To $17,000 To Multiple Family Members To Help Fund An Ira.

When gifting to an individual, he or she must not be a disqualified person and understand the cancellation of indebtedness rules. Then make sure you gift less than the annual exclusion amount (for 2022, it’s $16,000). Web smart gifting using retirement assets before you think about donating to charity, consider the source. Web a married couple could therefore give $36,000 to each of their children and grandchildren and anyone.

The Donor Should Gift The Funds Directly To The Family Member Or Friend And Then That Individual Can Make The Ira Contribution Into The Ira From The Funds Gifted.

Web it is possible to gift you ira to an individual or a charity. Web learn three ways to gift your retirement savings to your loved ones without paying taxes: Web it can be given to a family member, donated to a charity, or used to purchase other assets. Web you can gift money from an ira without paying taxes, as long as you meet a few requirements.

But If Your Gift Of Money From An Ira Surpasses A.

First, you’ll need to be over age 59 ½ and taking qualified distributions.